Funding & Payments

Funding & Payments

Since the commencement of our services in 2011, we have been supporting our projects and programs through contributions made primarily by our own members.

We raise funds by preaching the art of the “Joy of Giving” under the “Collective Fundraising Project”. Every small donation we receive is considered an invaluable investment that supports our beneficiaries – deprived children (V-kids) and their communities, who are often denied equal opportunities and justice in our society.

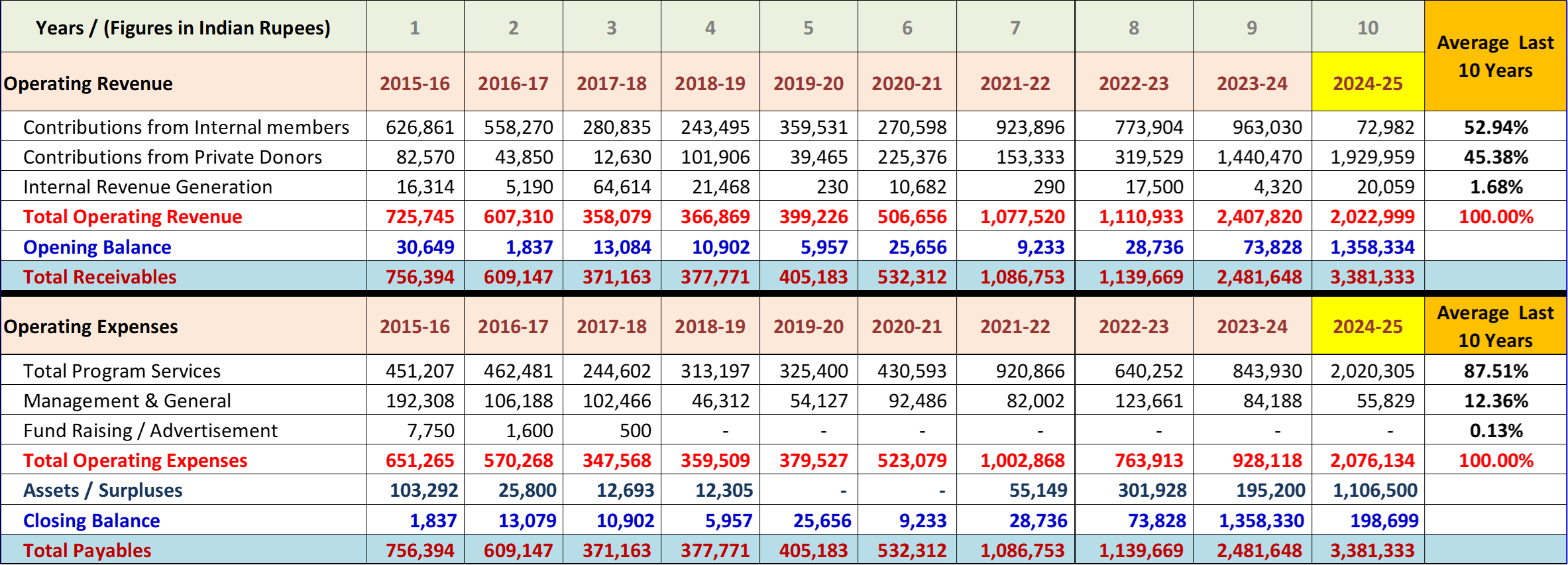

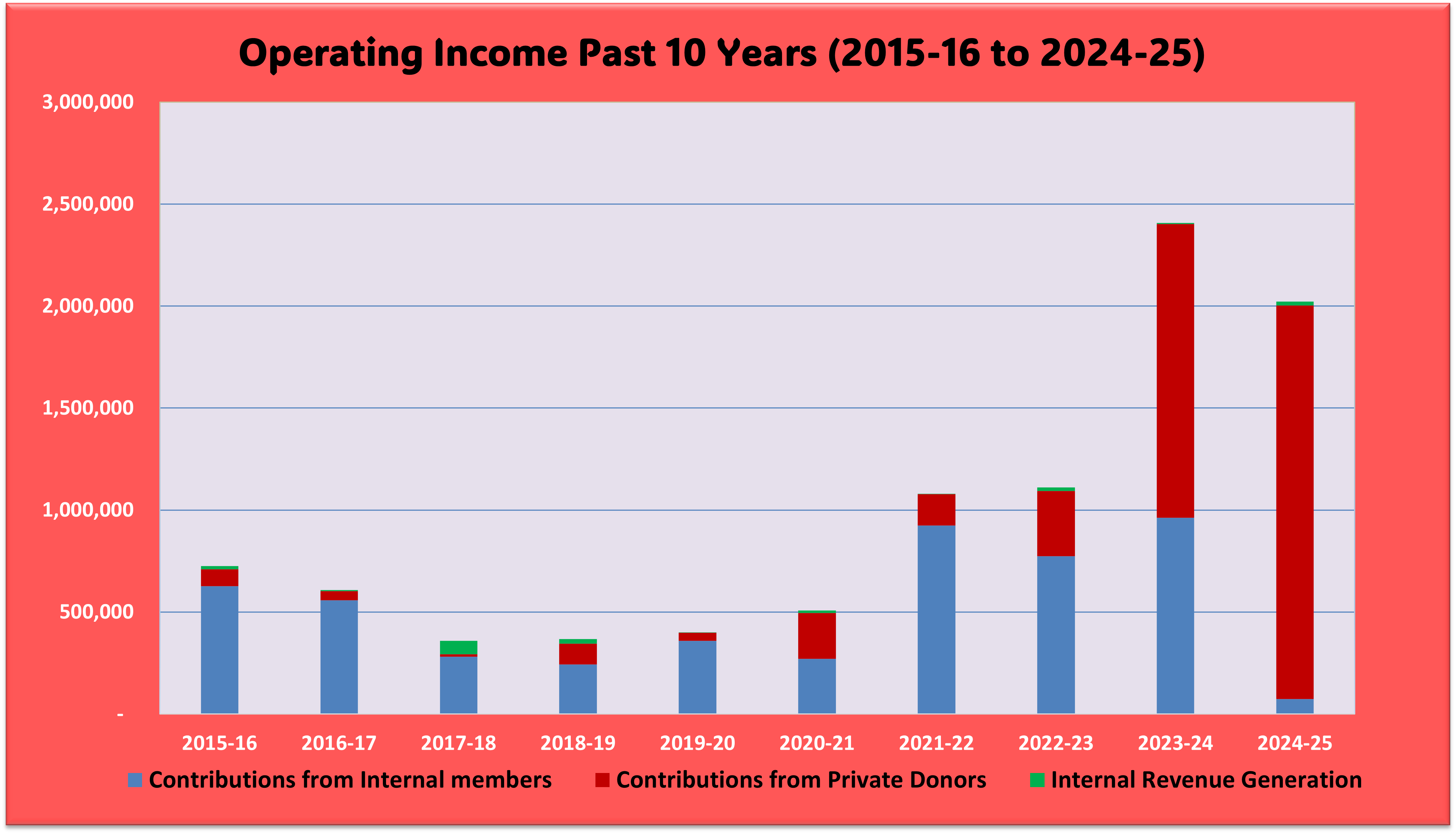

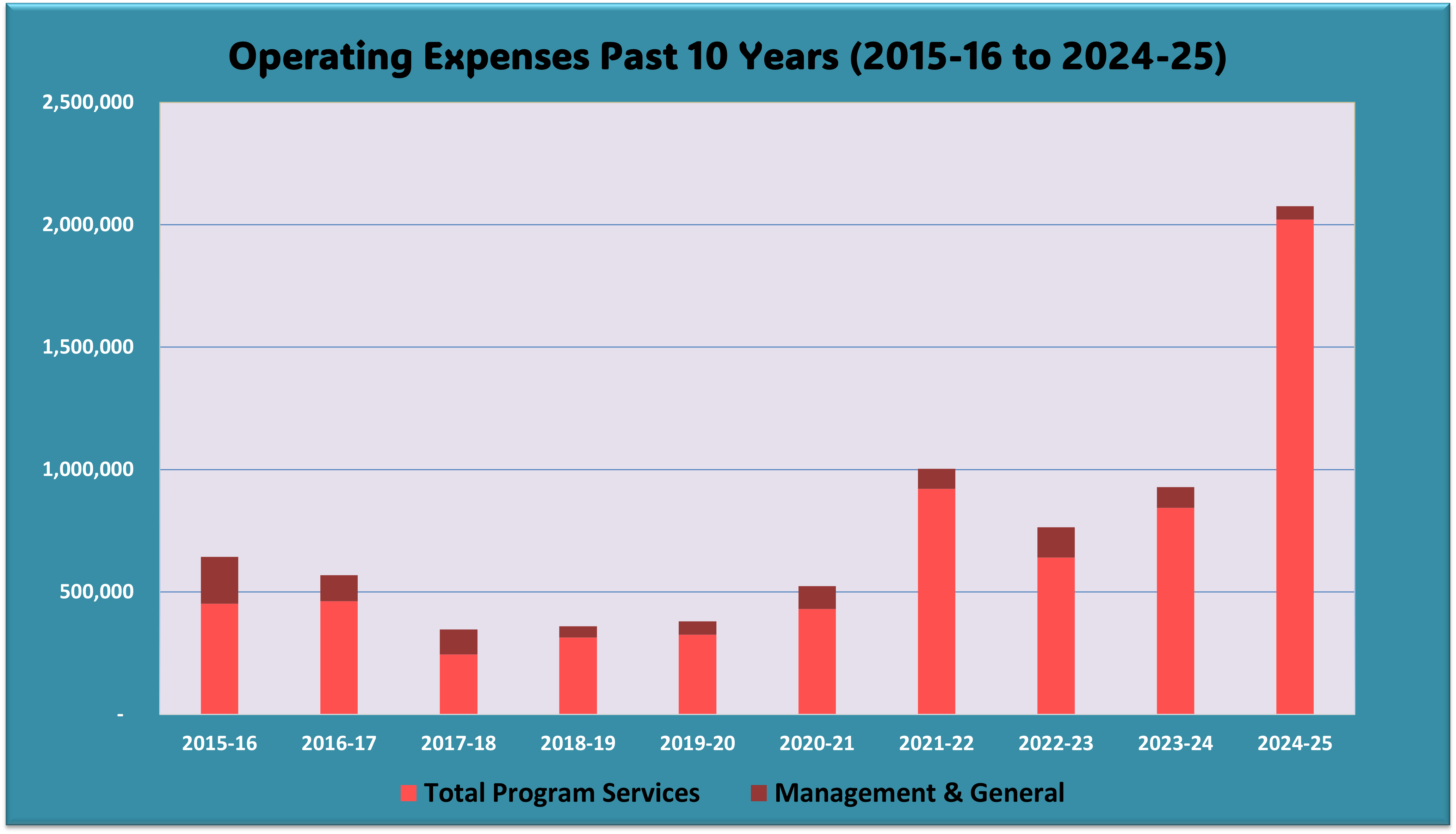

Financial Highlights for the last ten (10) years

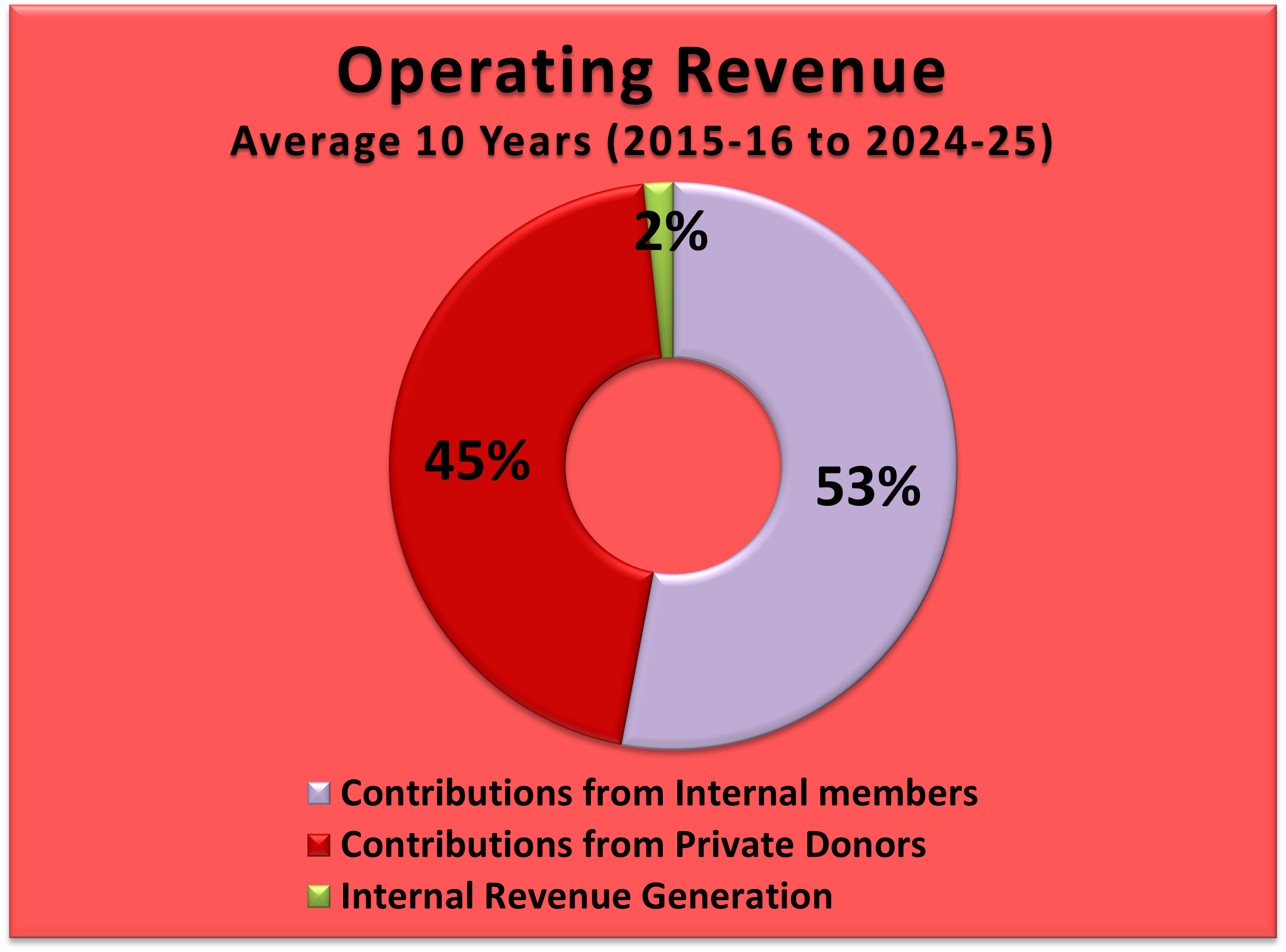

On average, for the last ten (10) years, from 2015-16 to 2024-25, we raised donations of about 53% from our own members and the remaining from external donors, including CSR partners and the local communities. We sustained our operations for more than a decade without any funding from outside agencies. The first time we got a CSR project was in March 2023 and we continue to scale up our services with the support of more project partners year by year.

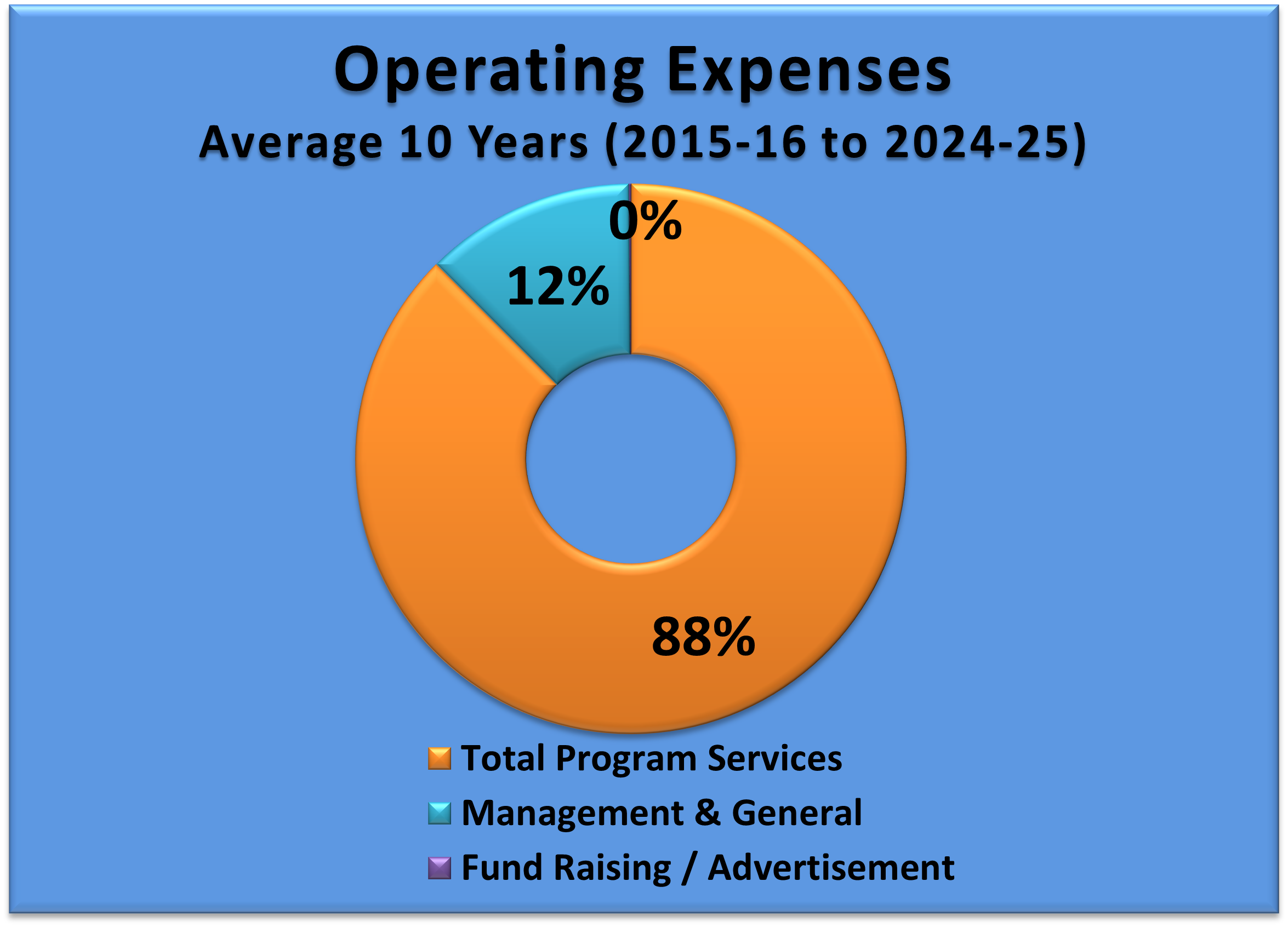

We spent more than 88% of our total operating expenses directly on programs that benefit deprived children (V-kids) and marginalized communities at the grassroots. Our management and overhead costs are less than 12%, attributing to primary administrative expenses, which are at the bare minimum.

We are expanding our service base geographically with PAN india presence. We seek participation from individual donors, charitable institutions, trusts, business organizations, research institutes, CSR companies, and overseas funding agencies to support our projects and programs to build a better world.

1. Annual Audited Reports and Financial Statements (Last 10 Years)

PARD INDIA is an Indian NPO (Registered as a Society), and we comply with the audit requirements as per the Income Tax Act of 1961. The following are the last 10 years' Audited Reports submitted to the Income Tax Department:

- Financial Audit Report of PARD INDIA (2023-24)

- Financial Audit Report of PARD INDIA (2022-23)

- Financial Audit Report of PARD INDIA (2021-22)

- Financial Audit Report of PARD INDIA (2020-21)

- Financial Audit Report of PARD INDIA (2019-20)

- Financial Audit Report of PARD INDIA (2018-19)

- Financial Audit Report of PARD INDIA (2017-18)

- Financial Audit Report of PARD INDIA (2016-17)

- Financial Audit Report of PARD INDIA (2015-16)

- Financial Audit Report of PARD INDIA (2014-15)

2. FCRA Reports

For the first time, PARD INDIA got the approval of FCRA on 28th October 2023, valid for 5 years until 27th October 2028.

FCRA Annual Audited Financial Statements

In accordance with the Rule 13(a) of the Foreign Contribution (Regulation) Rules, 2015, the audited financial statements pertaining to the foreign contributions are given below. This is solely for the purpose of complying with the requirements of the above-said Rule. This should not be copied or misused for any purpose.

FCRA Quarterly Donation Details

In accordance with the Rule 13(a) of the Foreign Contribution (Regulation) Rules, 2015, the audited financial statements pertaining to the foreign contributions are given below. This is solely to comply with the requirements of the above-said Rule. This should not be copied or misused for any purpose.

Year (2024-25)

Year (2023-24)

3. Legal Certifications

We are fully compliant with the legal requirements, being a Not-for-Profit Organization (NPO); the following are our main credentials:

- Summary of Legal Certifications

- Society Registration Certificate

- FCRA Certificate

- 80G Certificate

- 12A Certificate

- PAN Card (Charity ID)

- MCA Registration

- Darpan Unique ID

- Byelaws / Statutes / Constitution / Articles of Association

- Compiled Byelaws in one document in English (for reference)

- List of present Executive Committee Members as per bye-laws

We alone cannot make a difference; we need your support to bring a change at the grassroots.

You become our partner with a small act of kindness to support the deprived children and their communities in rural areas.

Get 50% of Tax Exemption under 80G.

Donate Now