Impact Measurement

Impact Measurement

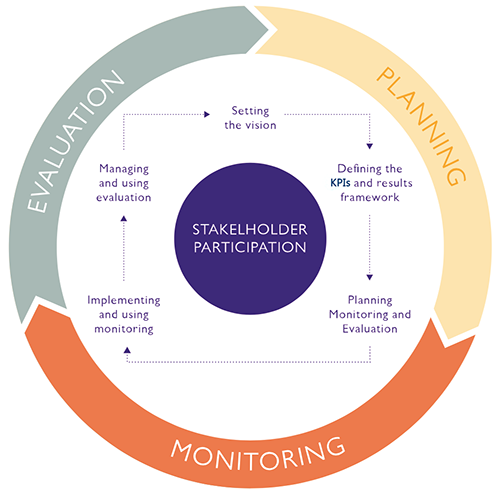

PARD INDIA practices the following best international standards of Monitoring & Evaluation (M&E) methods to ensure that every initiative leaves a lasting and positive impact on the deprived children (V-kids) and their communities that we serve:

- Setting the foundation and defining measurable impact metrics / KPIs – a first step

- Real-time data collection for enhanced decision-making

- Stakeholder engagement amplifying impact through collaborations

- Adaptable frameworks addressing complexities in a world of dynamic challenges

- Technology integration for efficient M&E outcomes

- Transparent communication and telling impactful stories

- Training and capacity building of M&E teams

- Continuous improvement through learning from successes and challenges

All our Projects & Programs have built-in impact assessment as part of project implementation, monitoring, and reporting mechanisms. We identify Key Performance Indicators (KPIs) with targets, and their actual impact is measured (both tangible and non-tangible) daily, monthly, and annually.

Our programs undergo regular evaluation, which helps us analyze the impact of our work, make informed decisions, and even change course if necessary, suiting the local needs as part of our continuous improvements and innovations.

All along the way, we share our results, from time to time, with all our stakeholders (donors, partners, beneficiaries, communities, members, volunteers, employees, and regulators), so that they can be aware of what change is being reported and can validate it through periodical reports, qualitative interviews, testimonials, impact stories, Newsletters, and Annual Reports which are made available in the public domain.

Find here: Impact Reports

Continuous Processes of Monitoring and Evaluation at PARD INDIA

1. Annual Audited Reports and Financial Statements (Last 10 Years)

PARD INDIA is an Indian NPO (Registered as a Society), and we comply with the audit requirements as per the Income Tax Act of 1961. The following are the last 10 years' Audited Reports submitted to the Income Tax Department:

- Financial Audit Report of PARD INDIA (2023-24)

- Financial Audit Report of PARD INDIA (2022-23)

- Financial Audit Report of PARD INDIA (2021-22)

- Financial Audit Report of PARD INDIA (2020-21)

- Financial Audit Report of PARD INDIA (2019-20)

- Financial Audit Report of PARD INDIA (2018-19)

- Financial Audit Report of PARD INDIA (2017-18)

- Financial Audit Report of PARD INDIA (2016-17)

- Financial Audit Report of PARD INDIA (2015-16)

- Financial Audit Report of PARD INDIA (2014-15)

2. FCRA Reports

For the first time, PARD INDIA got the approval of FCRA on 28th October 2023, valid for 5 years until 27th October 2028.

FCRA Annual Audited Financial Statements

In accordance with the Rule 13(a) of the Foreign Contribution (Regulation) Rules, 2015, the audited financial statements pertaining to the foreign contributions are given below. This is solely for the purpose of complying with the requirements of the above-said Rule. This should not be copied or misused for any purpose.

FCRA Quarterly Donation Details

In accordance with the Rule 13(a) of the Foreign Contribution (Regulation) Rules, 2015, the audited financial statements pertaining to the foreign contributions are given below. This is solely to comply with the requirements of the above-said Rule. This should not be copied or misused for any purpose.

Year (2024-25)

Year (2023-24)

3. Legal Certifications

We are fully compliant with the legal requirements, being a Not-for-Profit Organization (NPO); the following are our main credentials:

- Summary of Legal Certifications

- Society Registration Certificate

- FCRA Certificate

- 80G Certificate

- 12A Certificate

- PAN Card (Charity ID)

- MCA Registration

- Darpan Unique ID

- Byelaws / Statutes / Constitution / Articles of Association

- Compiled Byelaws in one document in English (for reference)

- List of present Executive Committee Members as per bye-laws

We alone cannot make a difference; we need your support to bring a change at the grassroots.

You become our partner with a small act of kindness to support the deprived children and their communities in rural areas.

Get 50% of Tax Exemption under 80G.

Donate Now